The risks of living in a snowglobe casino

Prediction markets let people place bets on real-world events, including geopolitical ones, often using knowledge most of us will never see.

Somebody made a $32,000 bet on the ouster of deposed Venezuelan President Nicolas Maduro when the odds were at 7% on Polymarket. When it happened days later, they profited a handsome $400k return. The prediction market in question, issued a statement saying insider trading isn't allowed on their platform.

Well that clears that up.

Whether the bet was legitimate or involved inside information is a distraction. The real issue as I see it, is most people today have no framework for understand that this sort of thing is even possible; that you financialize geopolitical events in real-time, and that the mechanics exist for people to profit from advanced knowledge of all sorts of things like military operations and that these systems operate entirely outside traditional regulatory structures.

Why it matters that you can gamble on real life events

Imagine you're eight years old, and some dares you to eat a bug for $1. Unless you're an aspiring daredevil or have an acquired taste for crickets, the money isn't going to convince you to do something you'd planned to do anyway. Now if your buddy convinces all of the third-grade class to pony up a buck, and you two split the proceeds, that ante might incline to make other choices.

Harmless example aside, this is essentially what we're faced with prediction markets. Except, instead of a Double Dare that gets a laugh and an ick out of your friends, we're talking about the potential instability of pacts that were once considered sacred.

Match-fixing is rampant but is mostly contained through harsh penalties and the fact that the sums are so insignificant that it takes aggregating lots of it to even be noticeable. Professional tennis deals with this a lot. The incentives for a "minor league" tennis player to throw points in a match at the behest of shadowy bettors is almost invisible until they get more brazen and/or sloppy.

Part of the reason I'm spending so much time talking about the civil economics of it all is because of the downwind impacts of these types of crimes. Localities are simply not prepared for the sorts of chaos that'll come from not being able to trust anything you can see. It's already rampant through platformization. You can't be sure your neighbor isn't renting out their apartment to strangers. You can short-term rent a car from someone and most of the time it all works fine. It's just when stuff breaks is where the system isn't sure who is liable, because the costs of all these decisions are mostly imperceptible by design.

Platformization wants us to enjoy frictionless experiences because we consume more that way, but the costs get shrouded and passed on.

What does this have to do with prediction markets?

Well, everything.

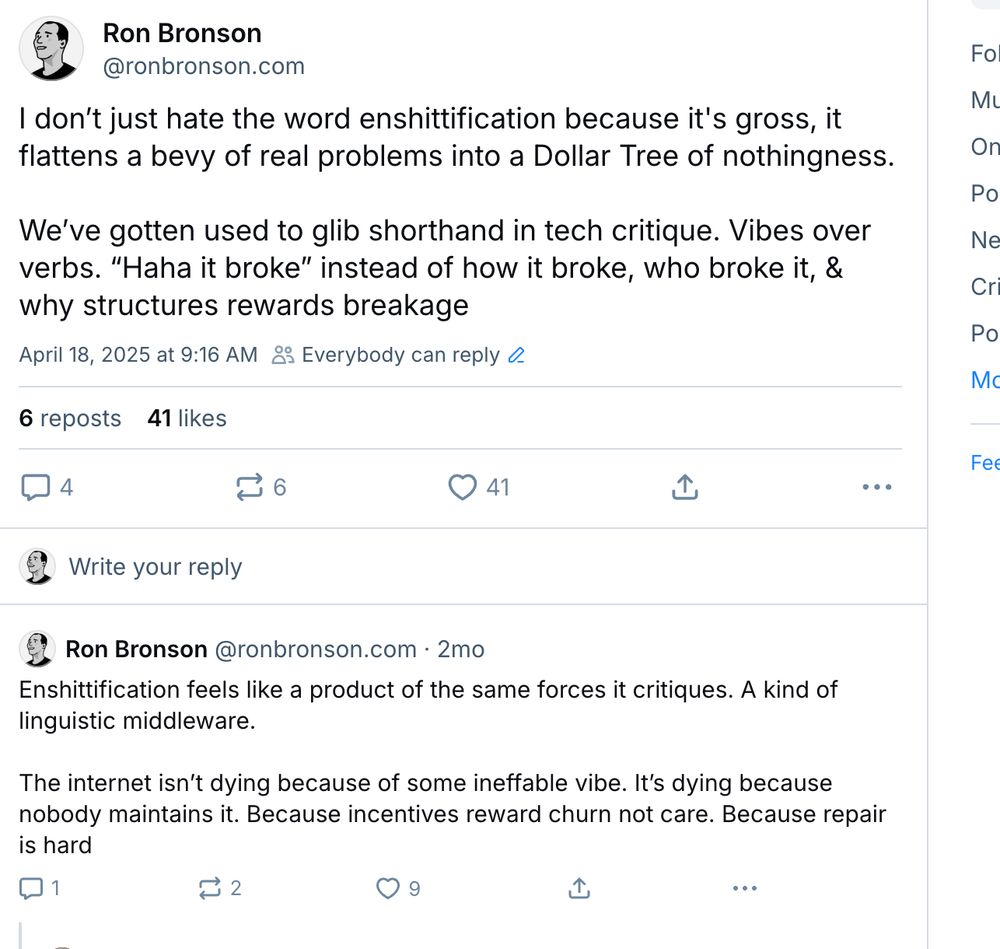

We don't have the words for what's happening in the margins

We’re living in asymmetric times. A small number of people can see systems forming and resolving in real time. Most people can’t, and there’s no obvious way they would.

There was a period when shared media gave us a rough sense of collective timing. We watched the same shows, argued about the same headlines, and even early social media allowed for a kind of shared simultaneity. That’s mostly gone. What’s left are bubbles that move at different speeds, with different signals and different stakes.

We’ve normalized this asymmetry in small ways. Job applications are filtered by machines before a human ever sees them. Platform labor shifts risk onto individuals who don’t control the system. Money moves through cities without leaving behind anything durable. None of this feels shocking anymore.

Smartphones and ubiquitous connectivity create the illusion that everyone is connected. But the gap between having access and having understanding keeps widening. Knowing how to use a device is not the same as knowing how power operates through it. That mismatch is fertile ground for conspiracy thinking, not because people are irrational, but because causality has become hard to see.

States are increasingly brittle because the rules they’re enforcing belong to a world that no longer exists. Systems calcify while the terrain shifts underneath them. It’s like playing Monopoly or the card game Spades where every house has its own rules, but no one ever explains them, and the rules keep changing mid-game. You only learn by losing. (I prefer house rules, fyi.)

I sometimes tell students that service design doesn’t exist. It’s a joke, but only barely. All the blueprints and maps in the world are meaningless if no one with signing authority can act on them. Power is only half the equation. The other half is the will to change the rules when they stop working—to fail fast, learn, and adapt—rather than insisting the game is fair because the rules say it is.

The point of my writing is to make the mechanics of problems more visible. To show how value moves, how risk is distributed, and why so much essential labor remains invisible. We collapse that work into phrases like “glue work” or “soft skills,” which makes it easy to ignore and impossible to protect.

Systems only work if we understand what they’re made of. I’ll keep writing about these moments as they surface, not because they’re exceptional, but because they’re signals. The pattern is already here. We just don’t have a shared language for seeing it yet.

The point of all my writing is trying to make the mechanics of problems more visible, so we can better understand how risk gets distributed on the ground.To show how value moves, how risk is distributed, and why so much essential labor remains invisible. We collapse that work into phrases like “glue work” or “soft skills,” which makes it easy to ignore and impossible to protect.

Systems can only work if we understand what they're made of.